With the Digital Operational Resilience Act (DORA) set to be enforced from January 17, 2025, financial firms across the European Union are racing against the clock to meet a crucial regulatory deadline. DORA's mission is to strengthen the digital resilience of financial entities by establishing a robust framework for managing Information and Communication Technology (ICT) risks. This framework includes harmonized standards for handling cyber threats and minimizing operational disruptions. As the countdown to compliance continues, organizations have only a few months left to align with these requirements. Non-compliance could lead to regulatory fines and pose serious risks to an organization’s reputation and operational continuity. Now more than ever, financial institutions—and their critical third-party ICT service providers—must ensure their digital infrastructures, processes, and policies are fully aligned with DORA's mandates to be ready for this significant regulatory shift.

What is DORA?

The Digital Operational Resilience Act (DORA) represents the European Union's initiative to create a unified framework for managing and mitigating Information and Communication Technology (ICT) risks within the financial sector. As the financial landscape becomes more interconnected across the EU, DORA aims to address the gaps and inconsistencies in digital resilience regulations that currently vary from one member state to another. By establishing a common standard, DORA seeks to enhance the overall resilience of financial entities and streamline the efforts of supervisory authorities in monitoring compliance across the union. This harmonized approach not only strengthens the EU's digital defenses but also fosters a more stable and secure financial environment.

Operational resilience refers to an organization's ability to withstand, adapt to, and recover swiftly from disruptive events. It encompasses how well a company can maintain critical operations, safeguard its assets, and protect its reputation, even in the face of unexpected challenges such as cyberattacks, system failures, or other crises.

The primary focus of DORA is the financial sector, encompassing not only traditional entities like banks, asset management firms, and insurance companies but also less conventional players, such as crowdfunding service providers and credit rating agencies. Additionally, DORA extends its reach to any third-party providers of critical ICT services to financial entities, regardless of whether these third parties are based within the EU or outside it. While the regulations apply to all financial entities, the specific requirements may differ based on an entity's size, type of activity, and overall risk profile, ensuring a tailored approach to enhancing digital resilience.

The 5 Pillars of DORA

DORA is more than just a regulatory requirement—it's a comprehensive framework designed to help organizations withstand and rapidly recover from disruptions, whether caused by cyberattacks, natural disasters, or even simple human error. To achieve this, DORA centers on five key pillars that form the foundation of its approach:

ICT Risk Management

Under DORA, financial entities must establish a robust ICT risk management framework designed to proactively address and mitigate potential ICT risks. This framework should encompass several key components:

- Building a resilient ICT infrastructure to proactively mitigate risks and minimize potential damage.

- Identifying all critical processes and assets and maintaining up-to-date documentation on them to ensure a clear understanding of what needs protection.

- Continuously monitoring potential sources of ICT risks to promptly detect and respond to threats as they arise.

- Implementing a detection system capable of identifying anomalous behavior that may indicate a cyber threat or operational issue.

- Developing and testing backup and recovery strategies and systems regularly to ensure swift recovery from any disruptions.

- Establishing capabilities and teams dedicated to gathering intelligence on vulnerabilities and cyber threats, allowing for continuous improvement of the entity’s security posture through lessons learned from both internal and external incidents.

DORA mandates that management be actively involved in the creation and governance of this framework, with clear roles and responsibilities outlined to ensure accountability. It also emphasizes the importance of thorough documentation, including details about assets (hardware, software, personnel), processes, dependencies, and their levels of criticality.

While DORA does not prescribe a specific risk management framework, it gives entities the flexibility to adopt an existing framework—such as NIST’s Risk Management Framework, ISO/IEC 27000 series, or OCTAVE—or to develop a tailored framework that meets their unique needs.

ICT-related incident management

Under DORA, the reporting of ICT-related incidents and cyber threats is a critical obligation, with requirements that may demand an incident to be reported within as little as four hours of its occurrence. To comply, entities must develop a comprehensive incident response plan detailing how to detect, manage, and report ICT-related incidents promptly.

Incidents should be classified based on their impact using specific criteria, such as the number of clients affected, the duration of the incident, geographical spread, data loss involved, the criticality of the services impacted, and the economic consequences.

Entities are required to prepare initial, interim, and final reports on ICT-related incidents, using standardized templates provided by the European Supervisory Authorities (ESAs). These templates ensure a harmonized approach to incident reporting and contain specific information that can be found in the ESAs' detailed guidance here.

Digital Operational Resilience Testing

As part of their ICT risk management framework, financial entities are required to establish, maintain, and periodically review a comprehensive digital operational resilience testing program. This program is designed to evaluate an organization's readiness to handle ICT-related incidents and must adopt a risk-based approach. It should take into account the evolving landscape of ICT risks, the criticality of the assets or services involved, and other relevant factors.

The testing program should carefully select the appropriate type of test for each asset or process. These could include vulnerability assessments, open-source analyses, gap analyses, and other relevant testing methods. For ICT systems and applications that support critical or important functions, testing must be conducted at least annually to ensure their robustness and resilience.

In addition to regular testing, most financial entities (with exceptions for certain micro-enterprises) are required to perform threat-led penetration testing on critical or important functions at least once every three years. This more rigorous testing approach helps identify potential vulnerabilities from the perspective of an attacker, ensuring a more proactive defense against emerging cyber threats.

Third-Party ICT Risk Management

DORA's impact extends beyond financial institutions to include third-party ICT service providers deemed critical to these institutions. This regulatory oversight applies not only to direct third-party providers but also extends up the supply chain, potentially reaching fourth-party and fifth-party providers.

Under DORA, financial entities are required to assess their third-party service providers based on several key criteria:

- The potential impact on the entity's operations if the third-party provider experiences an operational failure.

- The extent of the entity's reliance on the third-party provider.

- The criticality of the services provided by the third-party for the entity’s core operations.

- The ease with which the third-party provider could be substituted if necessary.

After identifying and evaluating third-party service providers based on these criteria, financial entities must establish a comprehensive system to monitor and manage the associated risks. This ongoing oversight is essential to ensure that all third-party relationships are secure and do not pose undue risk to the financial institution’s operational resilience.

Information Sharing

Information sharing under DORA is a voluntary initiative that enables financial entities across the EU to establish communication channels for exchanging cyber threat intelligence and other pertinent information. This collaborative approach allows institutions to stay informed about emerging threats and vulnerabilities, enhancing their collective ability to manage and mitigate risks.

Additionally, supervisory authorities will contribute to this effort by providing relevant, anonymized information to financial institutions. This helps organizations stay current with the latest threat intelligence and best practices, supporting proactive and effective risk management strategies

Here is a well-organized website where you can access the official DORA regulation in a comprehensive and detailed format : https://www.dora-info.eu/dora/

How can Brainframe help with DORA?

ICT risk management

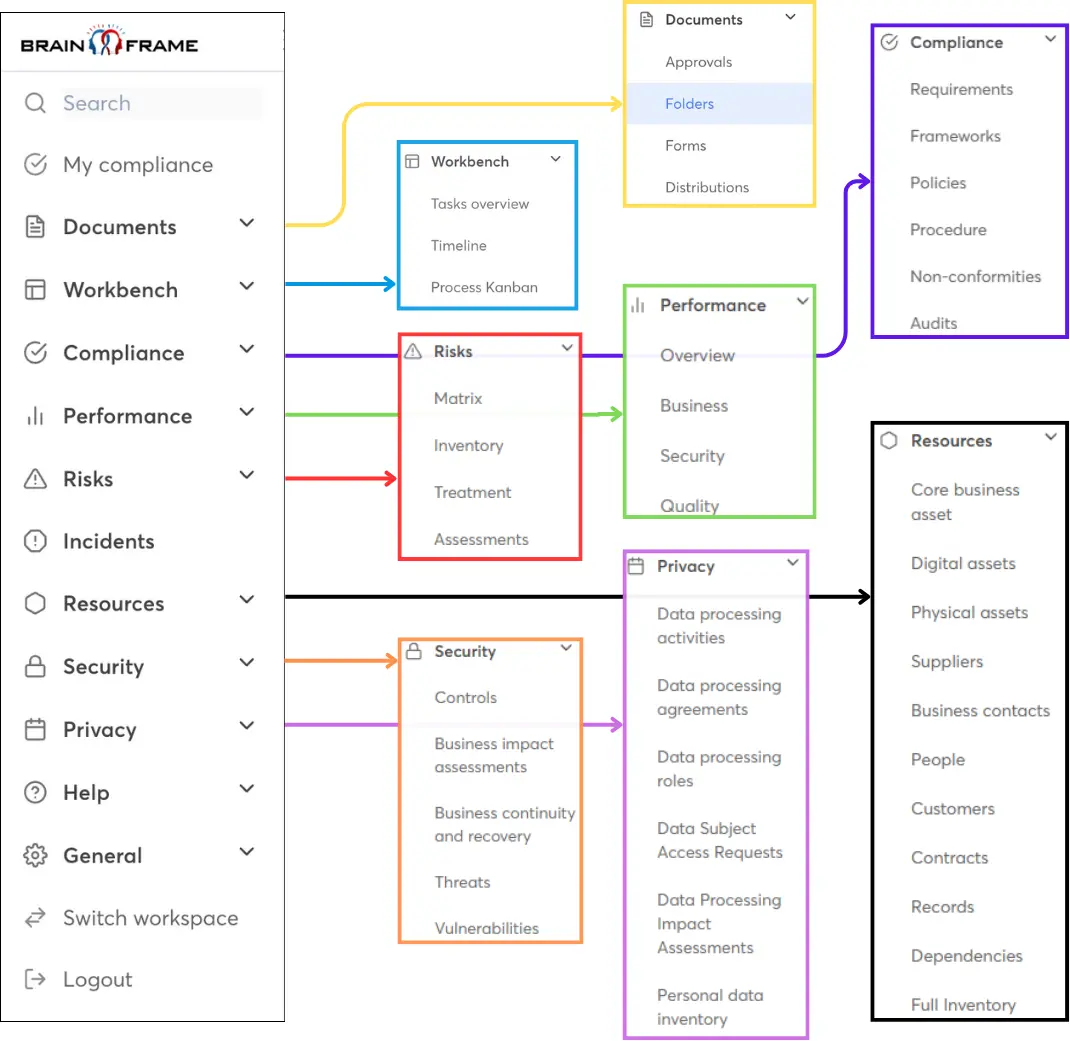

Brainframe provides a comprehensive solution for managing ICT risks, aligning seamlessly with DORA’s requirements. It offers a structured approach to identifying, assessing, and managing risks by implementing robust policies, procedures, and controls to protect information assets. Brainframe also ensures compliance with regulatory requirements for documentation management, efficiently tracking changes, approvals, and reminders, and supporting standardized documentation across all domains with user-friendly templates.

Our platform facilitates the systematic assignment and tracking of tasks related to controls, assets, suppliers, risks, and non-conformities. With integrations into tools like Asana, JIRA, and Monday.com, Brainframe offers a consolidated view of all risk reduction activities. It also enables users to map assets to relevant processes—a key DORA requirement—and import existing documents from local or cloud environments.

Brainframe allows a clear definition of roles and responsibilities for each asset, risk, and control, allowing for effective risk management by department and providing a comprehensive overview of the risk landscape. It supports the design, execution, and monitoring of business processes for transparent process management, complemented by process-driven residual risk management. This offers a contextual view of suppliers, employees, stakeholders, non-conformities, risks, and applicable regulations.

The platform provides an immediate inventory of all your documents—such as assets, policies, procedures, and contracts—that can be readily presented to authorities upon request. It assists in centrally cataloging primary assets and their supporting elements, along with associated risks and business requirements, ensuring thorough documentation and compliance.

Brainframe also visualizes strategic goals and milestones, helping organizations meet regulatory requirements for strategic planning and tracking. This includes managing audit plans, risk reduction efforts, and non-conformity treatments. The platform offers insights into how assets, processes, suppliers, risks, and controls interconnect, facilitating better decision-making and risk management.

Additionally, Brainframe automates the distribution of documents and training materials to stakeholders, collecting proof of acknowledgment and understanding. The built-in editor allows for the creation and storage of multiple versions of process flows, ensuring that all information is up to date and easily accessible. The platform also enables quick capture and linking of online resources to relevant suppliers, risks, or other investigative work, keeping all critical data centralized.

Brainframe maintains “golden documents” for commonly used data, ensuring that updates are reflected across all workspaces while keeping entity-specific work isolated. Governance features allow for precise control over who can access different parts of the platform, ensuring secure and efficient management of all digital operational resilience efforts.

ICT-related incident management

Brainframe empowers organizations to establish and maintain a robust incident response plan, tailored to meet the specific needs of each asset. With Brainframe, you can efficiently define and manage the critical actions required in response to various types of incidents, ensuring that every asset is adequately protected. The platform enables the creation of detailed workflows for each stage of an incident response, from initial detection and assessment to containment, eradication, recovery, and post-incident analysis. This structured approach ensures that your team is always prepared to respond swiftly and effectively, minimizing the impact of any disruption.

To meet DORA's stringent ICT-related incident reporting requirements, Brainframe offers customizable templates that streamline the entire reporting process. These templates can be pre-filled with relevant and static information, such as predefined incident categories, contact details of key personnel, and standard operating procedures. This not only accelerates the incident reporting process but also reduces the likelihood of errors, ensuring compliance with regulatory timelines. By leveraging Brainframe's automated features, organizations can maintain a comprehensive and up-to-date incident log, quickly generate detailed reports, and share them with the appropriate stakeholders and regulatory bodies, all while maintaining a clear audit trail for future reference.

Resilience testing

DORA mandates that financial entities conduct regular digital operational resilience testing to ensure they are adequately prepared for ICT-related incidents. This requirement poses a challenge for organizations to continually identify vulnerabilities, evaluate the effectiveness of controls, and ensure quick recovery from disruptions.

Brainframe addresses these challenges by providing a structured framework for resilience testing. It establishes clear testing procedures and schedules, ensuring that all critical systems and processes are regularly assessed. Through its comprehensive approach, Brainframe incorporates risk assessment methodologies and testing protocols to systematically identify weaknesses and validate the effectiveness of existing controls. Moreover, it supports the ongoing documentation, analysis, and refinement of resilience strategies, allowing organizations to adapt to evolving threats and maintain compliance with DORA’s standards. By following their resilience testing within Brainframe, financial entities can enhance their overall security posture and readiness to handle ICT-related incidents effectively.

Third-party risk management

DORA presents a significant challenge for financial institutions by requiring them to manage and monitor risks associated with third-party ICT service providers, extending even to fourth- and fifth-party providers. This means organizations must have a comprehensive understanding of not only their direct suppliers but also the vendors that those suppliers rely on. The complexity and interconnectedness of these relationships can introduce various risks, including data breaches, service disruptions, and compliance failures, which could compromise the institution's operational resilience.

Brainframe provides a robust framework to address these challenges by incorporating third-party risk management processes that evaluate and continuously monitor the security posture of third-party providers. Through a combination of due diligence procedures, regular security assessments, and contractual controls, it ensures that all third-party relationships align with the organization’s risk management strategy and regulatory requirements. This includes the implementation of clear policies for selecting, contracting, and reviewing third-party providers, as well as setting up performance metrics and compliance checks to monitor their ongoing adherence to security standards.

Moreover, it supports the creation of comprehensive oversight mechanisms, such as continuous monitoring of third-party performance and periodic audits, to promptly identify and mitigate any emerging risks. This proactive approach not only helps in managing current third-party risks but also in anticipating potential threats from downstream suppliers, ensuring that the organization remains compliant with DORA’s stringent standards

Resources

Start for free now!

Streamline your GRC work using our all-in-one management solution and get access to our network of local specialists