The real challenge of managing a cybersecurity budget lies in translating security spending into measurable business value. Decision-makers need to see how these investments contribute to revenue protection, cost efficiency, and strategic growth. We’ll explore how understanding risk components and leveraging metrics like Annualized Loss Expectancy (ALE) and Return on Investment (ROI) can help justify security expenditures. By aligning security initiatives with business goals, organizations can unlock their full potential.

Key Components of Risk: Understanding the Foundation

Security investments must address risks that threaten an organization’s assets. To evaluate and mitigate these risks effectively, it’s essential to understand their core components: asset, threat, vulnerability, likelihood, and impact.

Asset

- Definition: Anything of value to the organization, including data, systems, people, intellectual property, and reputation.

- Role: Assets form the foundation of risk assessments. Without assets, there would be no risks to manage.

Example: A financial firm’s customer database is a critical asset that, if compromised, could lead to regulatory fines and reputational damage.

Threat

- Definition: A potential event or action that could harm an asset.

- Examples:

- Cyberattacks, such as phishing and ransomware.

- Natural disasters like floods or earthquakes.

- Insider threats, such as unhappy or distracted employees.

Example: A manufacturing company faces the threat of ransomware attacks targeting its production systems.

Vulnerability

- Definition: A weakness in an asset or control that can be exploited by a threat.

- Examples:

- Unpatched software.

- Weak passwords.

- Inadequate access controls.

Example: An outdated firewall exposes a retailer’s point-of-sale system to malware attacks.

Likelihood (Probability)

- Definition: The probability that a threat will exploit a vulnerability.

- Role: Likelihood helps prioritize risks based on exposure.

Example: A healthcare provider operating in a region prone to hurricanes has a high likelihood of data center outages due to natural disasters.

Impact

- Definition: The consequences of a threat exploiting a vulnerability.

- Types:

- Financial: Revenue loss, fines, or legal fees.

- Reputational: Erosion of customer trust.

- Operational: Downtime and productivity losses.

- Legal/Regulatory: Non-compliance penalties.

Example: A data breach at a tech company could lead to a loss of customer trust, regulatory fines, and litigation costs.

ALE & ROI: Quantifying the Value of Security Investments

Security investments must be supported by financial justifications. Metrics like Annualized Loss Expectancy (ALE) and Return on Investment (ROI) provide the tools to translate security spending into business value. These metrics are particularly important for gaining executive buy-in, as they frame security initiatives in financial terms that resonate with business leaders. By demonstrating the tangible cost savings and risk reductions, ALE and ROI help bridge the gap between technical efforts and strategic priorities.

Annualized Loss Expectancy (ALE)

- Formula: “ALE = SLE × ARO”

- Components:

- Single Loss Expectancy (SLE): The cost of a single incident.

- Formula: “SLE = Asset Value × Exposure Factor” (percentage of loss).

- Annual Rate of Occurrence (ARO): The estimated frequency of the event in a year.

- Single Loss Expectancy (SLE): The cost of a single incident.

- Purpose: Helps calculate the expected annual cost of a risk, guiding investment decisions.

Example: If a company’s customer data breach has an SLE of €1 million and an ARO of 0.3, the ALE is €300,000. A €50,000 investment in encryption could significantly reduce this risk.

Return on Investment (ROI)

- Formula: “ROI = (Gain from Investment − Cost of Investment) ÷ Cost of Investment”

- Purpose: Demonstrates how security investments deliver financial benefits by reducing risks or enabling compliance.

Example: A firewall costing €50,000 reduces ARO from 0.3 to 0.1 or the ALE from €300,000 to €100,000, yielding a net benefit of €200,000 per year and an ROI of 400% (Cost was only €50,000).

Cost-Benefit Analysis

Evaluates whether the cost of implementing a security control is justified by the reduction in ALE or other costs.

- Formula: “Net Benefit = (Risk Before Mitigation − Risk After Mitigation) − Cost of Control”

- Purpose: Simplifies decision-making by quantifying the financial impact of security measures.

Example:

- Net Benefit

- (€300,000−€100,000)−€50,000

- €200,000−€50,000=€150,000

- The cost-benefit analysis shows a net benefit of €150,000, demonstrating that the €50,000 investment in encryption is financially justified by the reduction in annualized loss expectancy.

Examples of Business ROI from Security Investments

When trying to convince business decision makers about an investment, it is important not to use technical jargon, but instead talk in their language: Money

1. Preventing Financial Loss

Technical expression: We need to implement robust firewalls and intrusion detection systems to prevent ransomware attack.

Translation to business ROI:

- A €50,000 investment reduces the risk of a ransomware attack, which is estimated to occur every 3.3 years and costs €250,000 in downtime. This translates to a net benefit of €150,000 per year by minimizing potential losses and ensuring business continuity.

2. Ensuring Business Continuity

Technical expression: We should implement disaster recovery planning and backup systems.

Translation to business ROI:

- A €30,000 investment in disaster recovery reduces downtime from 8 hours to 4 hours, avoiding €40,000 in revenue loss per incident. Additionally, it safeguards €500,000 in annual SLA commitments, protecting customer relationships and trust.

3. Achieving Regulatory Compliance

Technical expression: We need to better manage GDPR compliance, such as encryption and logging.

Translation to business ROI:

- A €40,000 investment in encryption and logging avoids potential GDPR fines of up to €1 million for non-compliance, safeguards customer trust, and ensures uninterrupted business operations in regulated markets.

4. Protecting Intellectual Property

Technical expression: We should implement Data Loss Prevention (DLP) tools.

Translation to business ROI:

- A €40,000 investment in DLP tools safeguards proprietary designs valued at €5 million and prevents market share losses of €1 million annually, ensuring continued competitive advantage and revenue stability.

5. Increasing Competitive Advantage

Technical expression: We should implement ISO 27001 and get a certification.

Translation to business ROI:

- A €75,000 investment in ISO 27001 certification unlocks new market opportunities worth €1.5 million annually, strengthens customer trust, and positions the organization as a preferred and reliable provider.

6. Reducing Operational Costs

Technical expression: We want to implement automation for security monitoring (e.g., SIEM).

Translation to business ROI:

- A €100,000 investment in SIEM automation saves €150,000 annually in staff costs and reduces incident response time by 50%, significantly minimizing downtime and associated losses.

7. Building Customer Trust

Technical expression: For better security we need to implement multi-factor authentication (MFA) for user accounts.

Translation to business ROI:

- A €20,000 investment in MFA reduces fraud cases by 80%, enhancing customer satisfaction and retention, and drives a €500,000 annual revenue increase through improved trust and loyalty.

8. Enabling Innovation

Technical expression: We need to build secure DevOps practices for product development.

Translation to business ROI:

- A €50,000 investment in secure DevOps practices reduces time-to-market for new features by 20%, enabling faster market capture, and saves €100,000 annually by minimizing post-release fixes and vulnerabilities.

Key Tips for Framing Security Investments

To maximize buy-in for security initiatives, it is crucial to frame them in terms of their direct and indirect contributions to organizational goals. Security investments are often seen as cost centers, so presenting them in a way that highlights their value is essential. Here’s how to do it effectively:

- Revenue Impact: Demonstrate how security protects or enables critical revenue streams. For example:

- Example: Show how downtime prevention protects income by maintaining uninterrupted business operations. If a manufacturing plant’s operations halt due to a cyberattack, quantify the daily revenue loss and how a specific security measure prevents it.

- Cost Avoidance: Use concrete metrics like ALE to showcase the financial consequences of not acting. Examples include:

- Example: Quantifying potential losses from ransomware attacks, regulatory fines, or data breaches. For instance, “Not implementing third-party risk management could result in fines of up to €10 million under NIS2, whereas a €100,000 encryption solution eliminates this risk.”

- Efficiency Gains: Emphasize how security investments improve operational efficiency and reduce resource burdens. For instance:

- Example: Implementing automation tools, such as Security Information and Event Management (SIEM) systems, minimizes the time spent on manual threat detection, enabling IT teams to focus on strategic initiatives.

- Strategic Alignment: Link security initiatives to the company’s long-term business goals.

- Example: For a company aiming to expand into new markets, stress how robust security enables compliance with international regulations, opening doors to opportunities in regions with strict data protection laws.

- Relatable Metrics: Replace technical jargon with business-focused KPIs that resonate with stakeholders. Examples include:

- Example: Presenting how multi-factor authentication (MFA) reduced fraud rates by 80% and led to an estimated €500,000 increase in customer satisfaction-driven revenue.

By framing security initiatives around these themes, organizations can effectively demonstrate how cybersecurity investments are not merely expenses but essential enablers of business resilience, growth, and profitability.

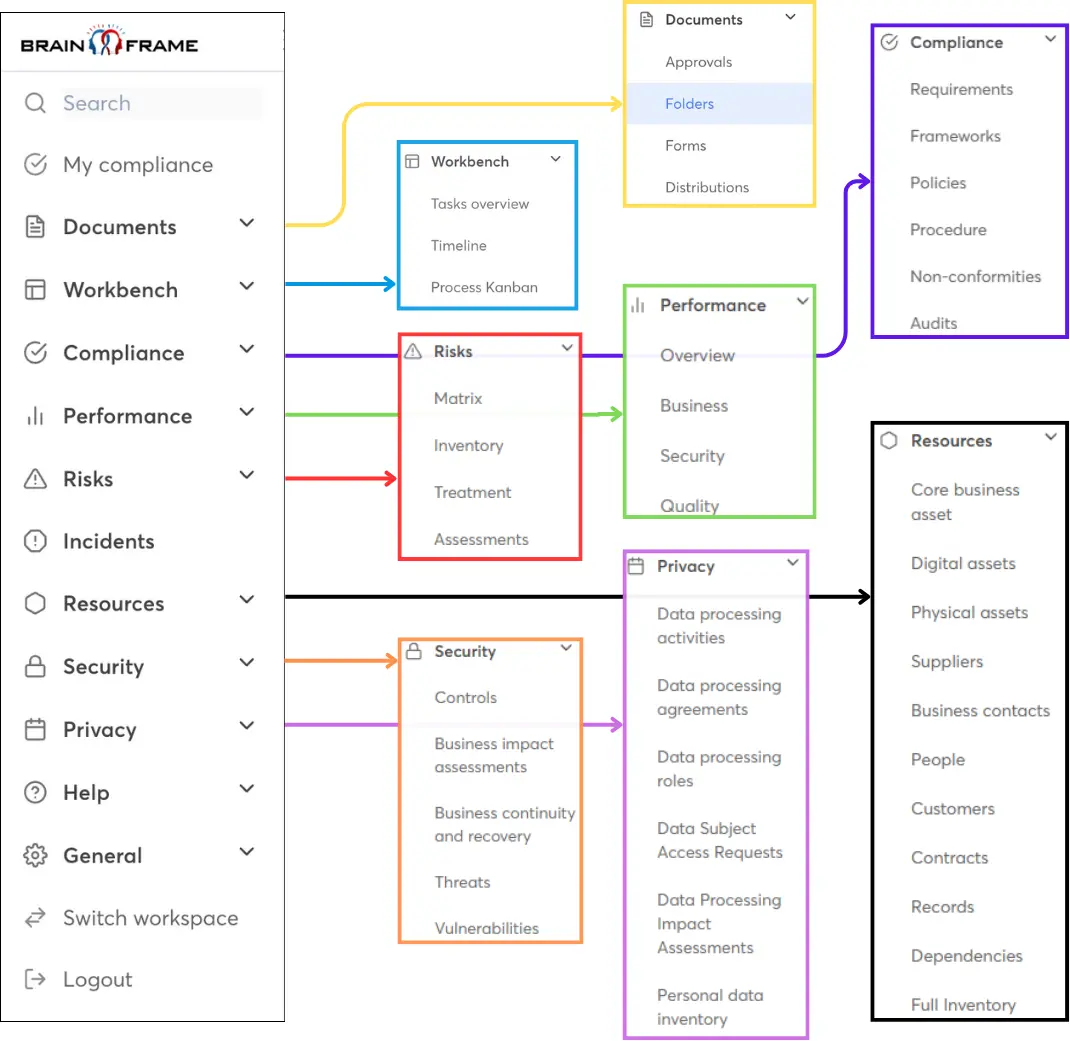

Start for free now!

Streamline your GRC work using our all-in-one management solution and get access to our network of local specialists